Your Guide to Spending in Industrial Properties available

Spending in business homes for sale offers an one-of-a-kind set of opportunities and challenges that call for a calculated method. Comprehending the various types of commercial properties, key aspects that affect their value, and the ins and outs of market research are important elements that can significantly impact your financial investment results.

Kinds Of Commercial Features

Commercial properties are often categorized into numerous distinct kinds, each serving particular objectives and attracting different sorts of capitalists. The main classifications include office complex, retail rooms, commercial residential or commercial properties, multifamily systems, and unique purpose residential properties.

Office complex are developed for organizations and can range from single-tenant buildings to large high-rises real estate multiple business. Retail spaces include shopping mall, standalone shops, and shopping malls, satisfying consumer requirements and preferences. Industrial properties include warehouses, making sites, and circulation centers, sustaining logistics and manufacturing activities.

Multifamily devices, such as home complicateds, provide household living spaces while producing rental revenue, making them attractive to investors looking for steady cash circulation. Special purpose buildings serve unique functions, including hotels, restaurants, and self-storage facilities, frequently requiring specialized understanding for effective monitoring and operation.

Recognizing these classifications is vital for possible capitalists. Each kind provides special investment opportunities and difficulties, influenced by market demand, place, and economic problems. Financiers must analyze their financial objectives and risk resistance when choosing the type of commercial residential property that aligns with their approach, eventually assisting their investment decisions in this diverse field.

Secret Elements to Think About

When examining potential investments in commercial residential or commercial properties, investors often take into consideration a number of essential elements that can substantially impact the success of their endeavors. One main consideration is the building's location. A prime place with high exposure and ease of access can attract renters and customers, inevitably improving rental income potential.

An additional crucial element is the property's condition and age. A properly maintained building may call for much less immediate funding expense, while older frameworks could demand substantial restorations, affecting overall success.

Understanding the zoning legislations and regulations is additionally important, as these determine the sorts of companies that can run on the residential or commercial property and may influence future growth possibilities.

Additionally, analyzing the financial performance of the residential or commercial property, including existing leases, rental prices, and tenancy degrees, supplies understanding right into its income-generating potential.

Doing Marketing Research

Extensive market study is crucial for educated decision-making in commercial property investments. Recognizing the regional market dynamics, including supply and demand trends, rental rates, and openings prices, is necessary to evaluate the possible success of a residential property. Assessing market information, such as population growth, income degrees, and work rates, can offer beneficial insights right into the location's economic viability and attractiveness to potential lessees.

Making use of on-line resources, local realty databases, and involving with market experts can boost your study efforts. Networking with neighborhood brokers and participating in neighborhood meetings can additionally generate important info regarding upcoming developments and zoning changes. Inevitably, comprehensive market research study furnishes investors with the expertise required to make tactical choices, decreasing risks and optimizing prospective returns in business residential property financial investments.

Funding Your Financial Investment

Protecting funding for your investment is a crucial look at this web-site step that can substantially influence your total success in the industrial genuine estate market. Traditional bank loans are the most common option, providing competitive interest rates and terms.

Alternative funding techniques include private money lending institutions and difficult cash car loans, which can assist in quicker access to resources however typically come with higher rate of interest. Additionally, think about commercial mortgage-backed protections (CMBS), which offer a broader swimming pool of resources and might have more adaptable terms.

An additional option is to discover collaborations or submissions, permitting multiple financiers to pool resources for bigger investments. This can lower individual economic danger while boosting purchasing power.

Despite the course chosen, conducting thorough due diligence is necessary. Analyze the terms, fees, and potential roi related to each funding alternative. Inevitably, the best financing technique will certainly straighten with your financial investment objectives and take the chance of tolerance, placing you for lasting success in the commercial realty landscape.

Managing Your Commercial Home

Additionally, developing a comprehensive marketing method is vital for bring in new lessees. Utilize online systems, social media sites, and neighborhood advertising and marketing to ensure your property reaches its target demographic. Consider using affordable lease terms and rewards to load openings swiftly.

Lastly, guarantee compliance with local laws and building upkeep requirements. Staying educated concerning legal responsibilities can assist reduce risks and prevent expensive penalties - commercial sales listings melbourne. By prioritizing efficient administration strategies, you can boost helpful site the worth of your industrial building and secure a lasting investment for the future

Verdict

Buying business properties uses substantial potential for monetary development, provided that cautious consideration is provided to different variables. By comprehending the sorts of buildings available and my site conducting complete market study, investors can make educated choices. Furthermore, checking out diverse financing options and properly taking care of buildings are important parts of success in this industry. Ultimately, a critical strategy to financial investment in industrial realty can yield substantial returns and add to lasting financial security.

Tia Carrere Then & Now!

Tia Carrere Then & Now! Michael Bower Then & Now!

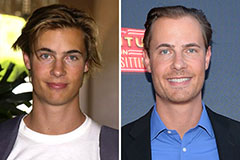

Michael Bower Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Jane Carrey Then & Now!

Jane Carrey Then & Now! Terry Farrell Then & Now!

Terry Farrell Then & Now!